how to lower property taxes in texas

Get breaking Finance news and the latest business articles from AOL. For example if your home is worth 500000 the assessed value comes out to 350000.

Papers from more than 30 days ago are available all the way back to 1881.

. Property Taxes On New Construction Homes are finalized and determined a few years later after the construction community is developed. El Paso County collects on average 209 of a propertys assessed fair market value as property tax. So vacant land will likely have lower real estate taxes due to a lower assessed value.

House Bill 3 was an 116 billion school finance bill that included 51 billion to lower school district taxes 65 billion in new school spending. There is a fee for seeing pages and other features. In the US property taxes predate even income taxes.

Related

That is the seventh-lowest rate in the state and far lower than rates in Oregons other most populous counties. Nothing like beachfront property. Property taxes can vary greatly depending on the state that you live in.

Located southwest of Portland Yamhill County has effective property tax rates somewhat lower than other counties in the Portland area. Theres no estate tax in Texas either although estates valued at more than 1206 million in 2022 and 1292 million in 2023 can be taxed at the federal level. North Carolinas median income is 55928 per year so the median yearly property.

The total of the rate between all the applicable tax authorities is the rate that homeowners pay. North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than North Carolina. Utah Property Tax Rates.

Death Taxes in Texas. Property taxes are one of the oldest forms of taxation. We provide a property tax reduction service to residential homeowners in exchange for a contingency fee of 50 percent of all property taxes saved through administrative hearings or judicial appeal for that tax year.

Assessment is based on a unit called a mill equal to one-thousandth of a dollar. Mortgage loan basics Basic concepts and legal regulation. Net operating income is the sum of all profits from rents and other sources of ordinary income generated by a property minus the sum of ongoing expenses such as maintenance utilities fees taxes and other expenses.

Tax system has many complexities different taxes are paid at. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. The average effective property tax rate in Douglas County is 084.

In Lewisville the countys second largest city the rate is lower at 2. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. You have a right to lower property taxes.

El Paso County has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. Property taxes in Texas are among some of the highest in the United States. There are many counties where that exempt property taxes.

This means that for the residents of Texas the maximum rate of income taxation is the top rate. Rent is one of the main sources of. For state and local governments property.

The median property tax in El Paso County Texas is 2126 per year for a home worth the median value of 101800. There are more than 1000 different property tax areas in Utah each with a separate rate. Connecticut Property Tax Rates.

Theres a good reason why though. However it does take time. While some states dont levy an income tax all states as well as Washington DC have property taxes.

The Highest Property Taxes by County. The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. In fact the earliest known record of property taxes dates back to the 6th century BC.

This pamphlet answers some frequently asked questions about the Womens Health and Cancer Rights Act. Exhibitionist Voyeur 120118. A mill rate is equal to 1 in taxes for every 1000 in.

Municipalities in Connecticut apply property taxes in terms of mill rates. Plus Democrats keep control of the Senate while the House is still up for grabs with key races still too close to call and the latest on President Joe Bidens foreign tour through Africa and Asia. How Do Texas Property Taxes Work.

Across the country there is a laundry list of services to fund students to support potholes to fill and communities to keep safe all with money collected via taxes. These areas are a product of the fact that counties cities school districts and water districts can all levy property taxes. From stock market news to jobs and real estate it can all be found here.

Property taxes are exclusively collected at the local level in the state and are generally at rates above the national average. Value of your home. The homeowner does not pay taxes on market value but rather on the lower assessed value.

Dread Lobster 453 Sunburnt in all the wrong places. Our team of Texas property tax consultants will research your property review appraisal district records appeal your case advocate for. With the help of the experts at Texas Protax you can lower your property tax appraisal value and save yourself the time stress and money.

Exhibitionist Voyeur 100518. The appraisal districts are responsible for determining the current market value of all property within the county on which tax payments are based. As one of seven states with no personal income tax cities counties and school districts have to rely on property taxes to fund operational costs or needed improvements.

How to Lower Property Taxes in Texas Types of Federal State and Local Taxes. SHUDDER BUG 471 LIGHTS. Owner-occupant tax rates are significantly lower than investment tax rates on real estate.

In addition Texas does not allow any lower level of government counties cities etc to impose an income tax. Therefore looking at specific counties will give you a better sense of how high property taxes can actually get. ATTOM Data Solutions reports that the counties with the highest effective tax rate as of 2020.

Cameras in all the right. The Indrabooty girls in Hi-Def. While it can help to consider state averages property taxes are typically set at the county level.

Molly takes Key West by storm. That includes both the land itself and the structures on it. Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015.

Five of the Lowest Property Taxes in Texas by County in 2019. Why are property taxes in Texas so high. Residential property in Texas is appraised annually by county appraisal districts.

State law prescribes a procedure for protesting the assessed value of your property. Nearly 50 of Texas residents are paying too much in property taxes. Federal law requires group health plans that cover mastectomies to also cover reconstructive surgery.

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Amazon Com Cut Your Texas Property Taxes Learn How To Fight Aggressively To Lower Your Property Taxes Ebook O Connor Mai Patrick Kindle Store

Texas Leaders Propose Raising State Sales Tax To Lower Property Tax Rates Kvue Com

Property Tax Education Campaign Texas Realtors

How To Really Protest Your Taxes In Texas Home Tax Solutions

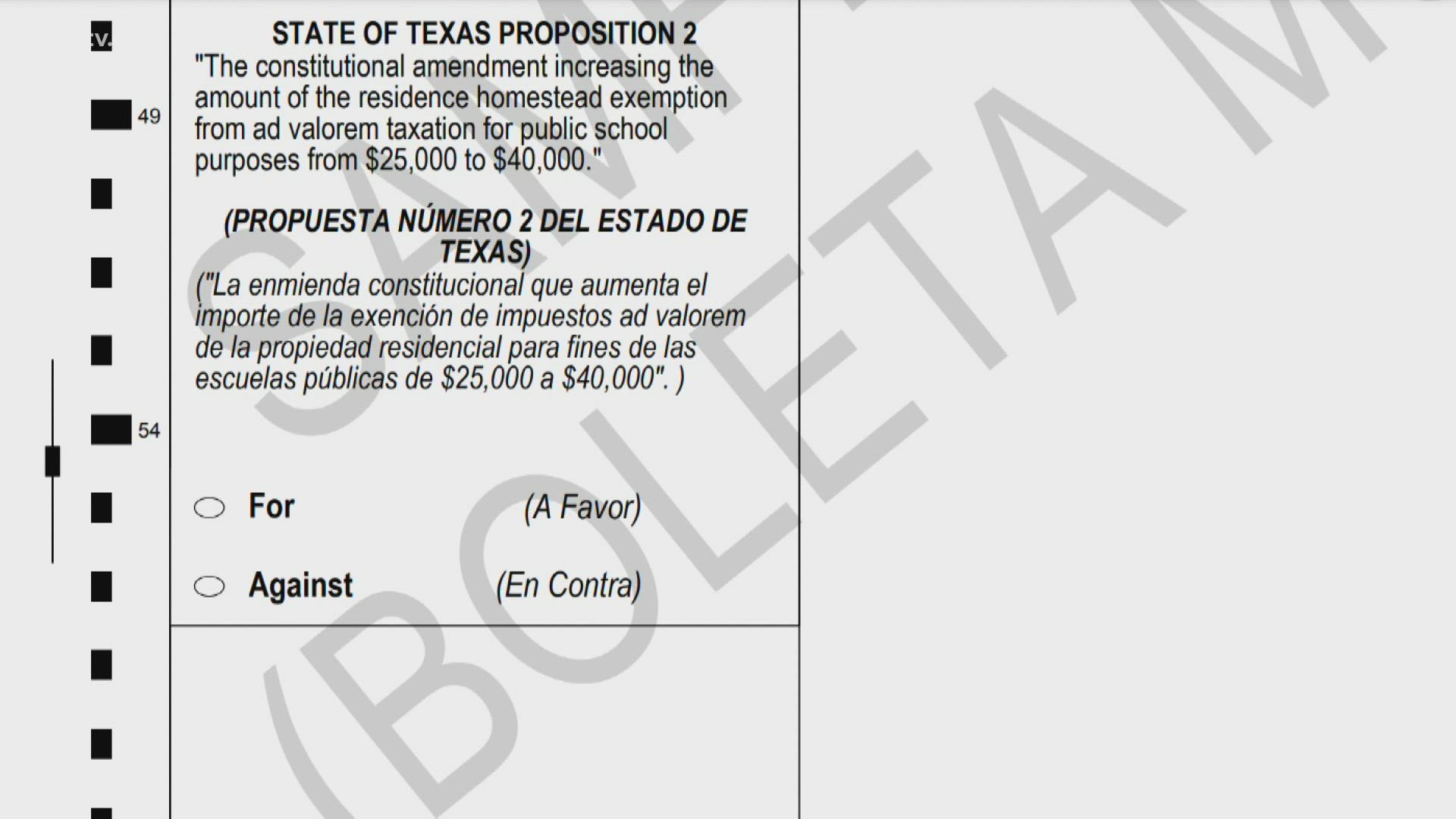

Here S How Two Texas Constitutional Amendments Could Lower Some Property Taxes

How To Lower Your Property Taxes In Texas

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Tarrant County Tx Property Tax Calculator Smartasset

Texas Gov Candidates Vow To Lower Property Taxes But How

Lower My Texas Property Taxes Llc 36 Connections Dallas Tx

As Texas Overhauls Schools Property Taxes Voters Wary Ut Tt Poll Says The Texas Tribune

Texas Property Taxes Among The Nation S Highest

Texas Voters Will Decide Whether To Lower Some Property Tax Bills In May Election Kera News

Tac School Property Taxes By County

Property Taxes By State County Lowest Property Taxes In The Us Mapped